TFCU will be closing at 2pm on Tuesday, December 24th and closed on Wednesday, December 25th in obervance of Christmas.

FRAUD ALERT: We have received reports from some of our members stating that they have received a phone call claiming to be from Taunton Federal Credit Union's Fraud Department requesting debit card numbers, expiration dates and the 3 digit security code on the back of the card. Please be aware that these communications are fraudulent and are not being made by TFCU. Do not respond or provide any personal information, instead call TFCU directly.

We want you to stay connected to your accounts from wherever you are 24 hours a day, 7 days a week! Just click, tap or dial to get account information, transaction history, pay bills, transfer funds, deposit checks or check balances!

With our Online Banking you’ll be able to access your accounts 24/7 via tauntonfcu.com.

Once enrolled, you’ll be able to:

Click here to to login or enroll in Online Banking on your device

Use these links to download our app: Apple Store | Google Play Store

Paying bills just got easier with TFCU’s Bill Pay service. You can save time and money by paying your bills online and best of all, as long as you pay at least one bill a month, it’s FREE!*

Features include:

*Bill Pay will be offered at no fee with all TFCU checking products providing at least one bill is paid per month through the system. A non-usage fee of $4.95 per month will be charged otherwise.

With TFCU’s Mobile Deposit, within our Mobile App, you can deposit checks anytime, anywhere!

Once enrolled, simply endorse your check with “Mobile Deposit”, take a picture of the front & back of the check with your smartphone’s camera & upload the images safely & securely to your TFCU account.

Important information you need to be aware of regarding our Mobile Deposit system:

The following items are NOT accepted through the Mobile Deposit System:

Go paperless by enrolling in eStatements & eNotices! These services are fast, safe, convenient, free and will help the environment by cutting down on paper usage!

eStatements and eNotices:

Log in to your account in Online Banking to enroll today!

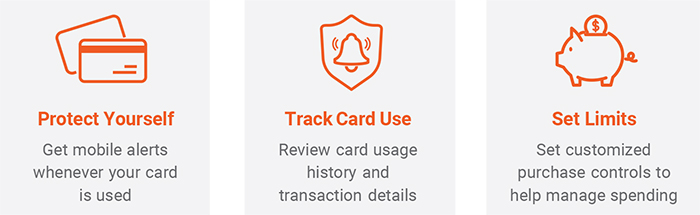

Protect your debit card by setting up transaction alerts while also having the ability to define when, where and how your card is used. Simply download the app to your smartphone, then customize your alert preferences and usage settings to monitor and manage your debit card.

Use the links below to download the app today!

Enjoy fast, convenient and safe payments with your TFCU Visa® Debit Card & your phone’s mobile wallet!

Mobile Wallets allow you to make purchases in stores or within participating apps by simply holding your device near the card reader or selecting the option when making a purchase in-app.

Mobile Wallets are a more secure way to use your TFCU Visa® Debit Card. Your card information, including name & number, are encrypted and not stored on your device. Each transaction generates a security code and requires you to use your phone’s authentication method such as a passcode or Touch/Face ID features to completed the purchase. These features are designed to protect you against card fraud.

Find your Digital Wallet below for more information and instructions on how to add your card to your device

At TFCU, we’re committed to protecting our members against fraud, which is why we have partnered with Fiserv to monitor your Debit Card transactions for potential fraudulent activity.

With Automated Fraud Alerts, you can receive alerts of potential fraud in the following ways:

If fraudulent activity is suspected when using your debit card, you will be notified by Fiserv and have the option to state whether this activity is fraudulent or not. If yes, your card will be temporarily blocked. If no, you can continue to use your card.

If you have any questions please call (508) 824-6466 and speak with a Member Service Representative today.

TFCU’s fraud alert service is operated by Fiserv, who is operating on behalf of TFCU. If you have been contacted by a Fiserv representative and do not wish to provide confirmation of your transactions with them, you may contact a TFCU Representative at (508) 824-6466 during regular business hours, otherwise your Debit Card will be restricted for use. You are responsible to keep your address and phone number updated with TFCU at all times. Data rates may apply. There is no service fee for Fraud Alerts, but you are responsible for any and all charges, including, but not limited to, fees associated with data usage, imposed by your Carrier.

Utilize the MoneyPass® ATM Network to get cash at over 37,000 Surcharge-Free ATMs. Click here for more information